Introduction

As part of Armenia’s commitment to fair and transparent taxation in the digital economy, the e-VAT System was launched in 2022 to simplify VAT registration and reporting for non-resident companies providing electronic services to Armenian customers.

The system was developed to help Armenia align with OECD and EU digital taxation principles, ensuring equal treatment of local and foreign providers and strengthening cross-border tax compliance.

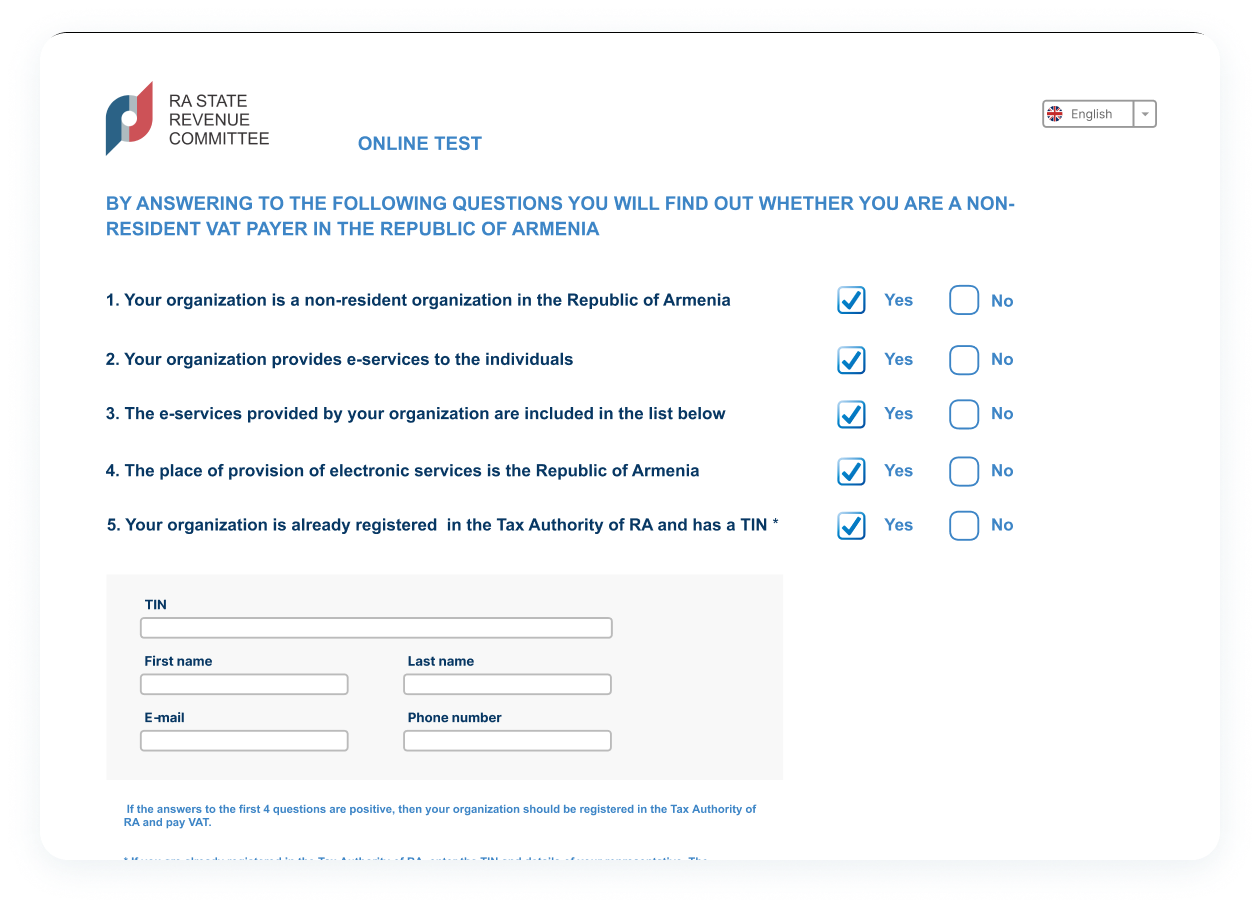

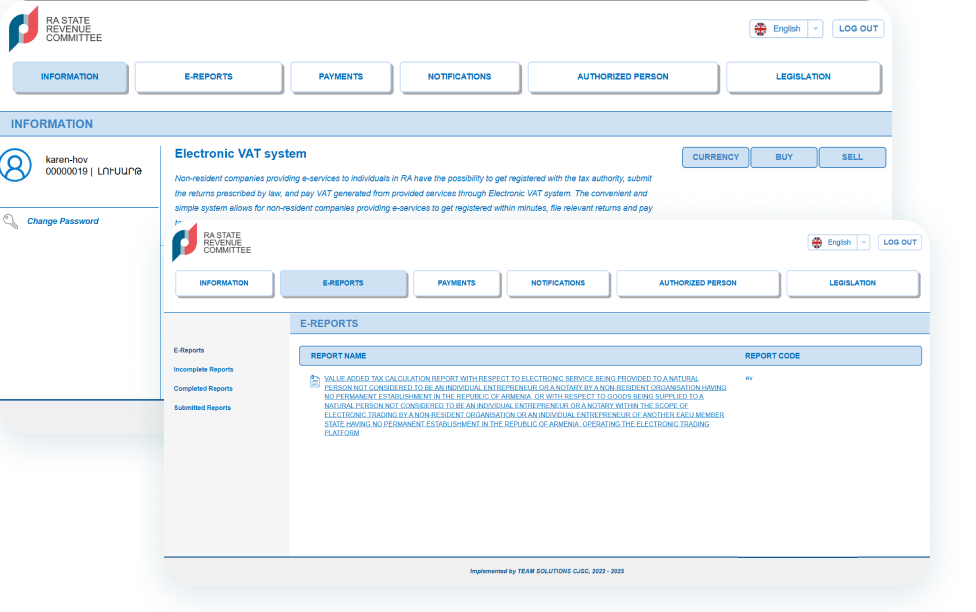

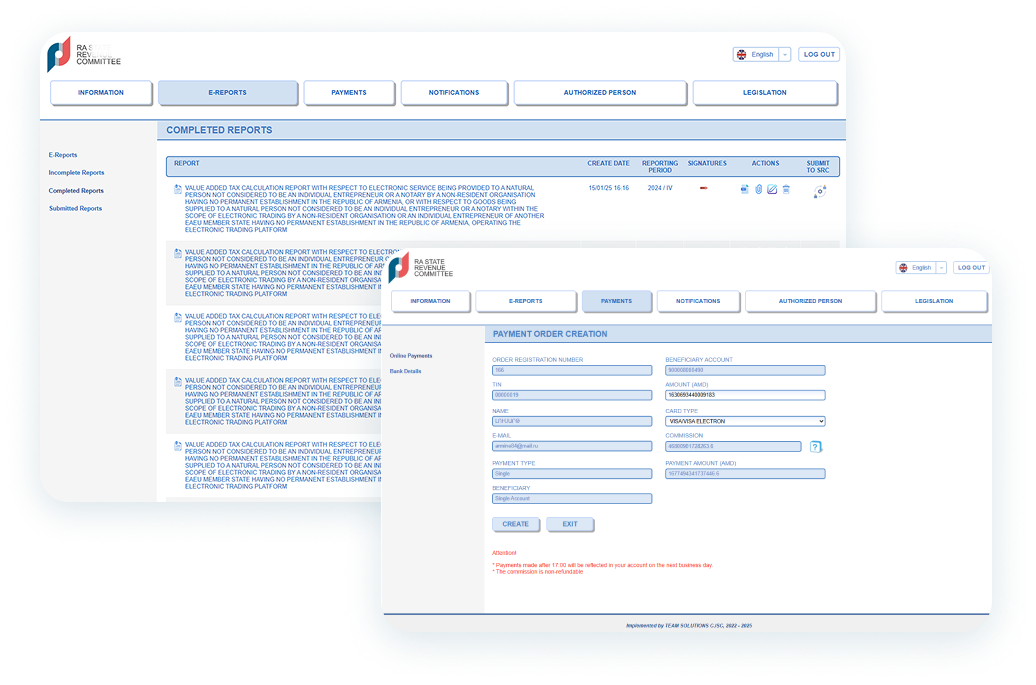

Through this user-friendly online platform, non-resident providers can register electronically, file tax returns, and pay VAT instantly by card, all without the need for a local bank account.

Since its launch, the system has demonstrated strong and continuous growth:

2022: 43 non-resident companies registered, paying 1.6 billion AMD in VAT.

2023: Registrations increased to 54 companies, with VAT payments rising to 2.7 billion AMD.

2024: Adoption continued to grow — 69 companies registered and contributed 5.1 billion AMD.

2025 (first half): Already 69 companies have registered, with 3.1 billion AMD paid to the state budget.